-

cnbc wrote a new post, How to earn $40,000 in interest every year in retirement, on the site US Stock Info 4 years, 9 months ago

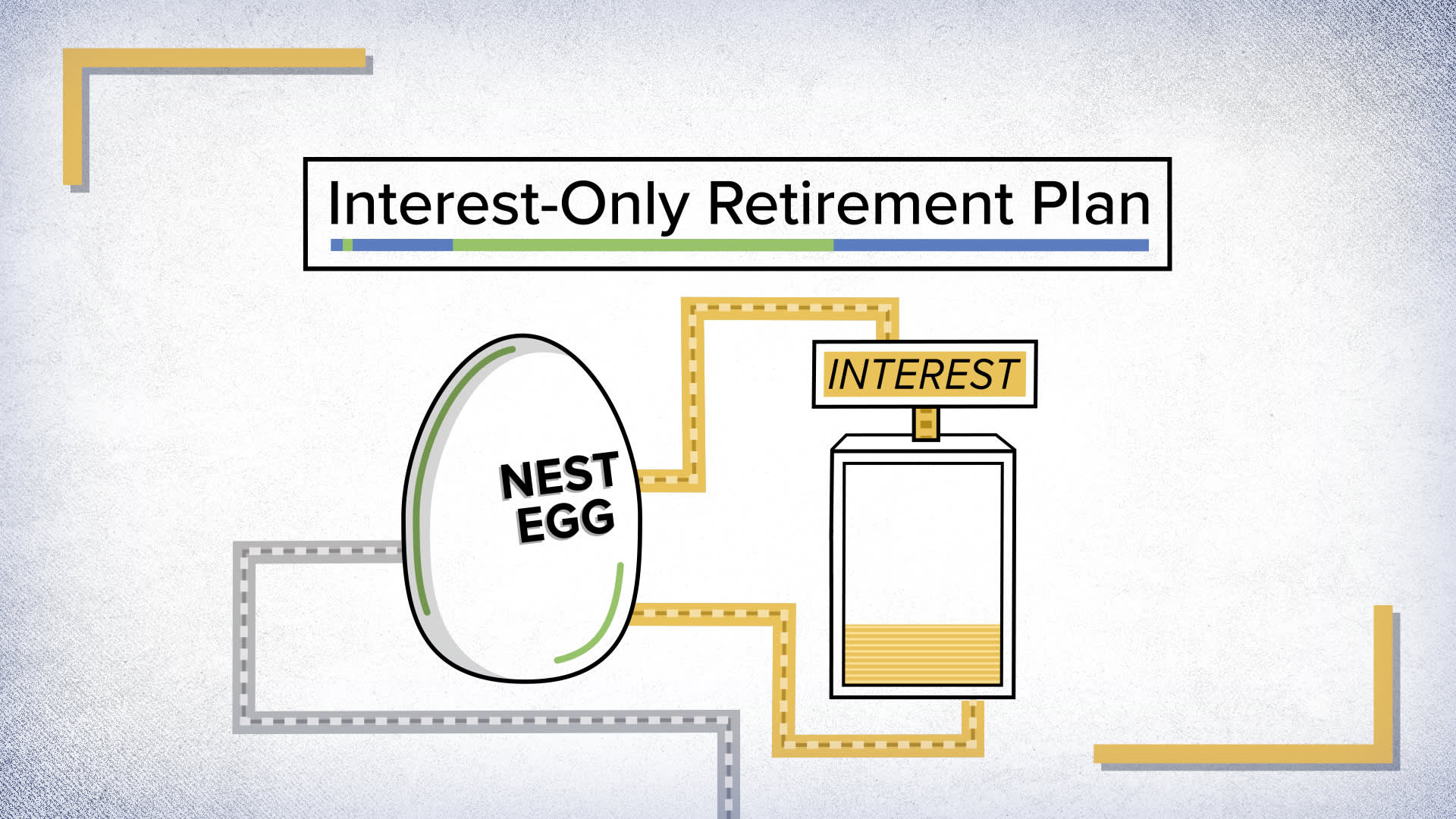

How to earn $40,000 in interest every year in retirementAn “interest-only” retirement plan can fund your golden years without draining your savings, but you will need to save a lot of money to make it possible. NerdWallet crunched the numbers, and we can tell you how much you need to save every month, broken down by age, to get $40,000 every year in an “interest-only” retirement. Check out this video to learn how to make it a reality.

-

cnbc wrote a new post, When it pays to take a personal finance course, on the site US Stock Info 4 years, 9 months ago

And yet, when it comes to financial literacy, Americans are still falling far short. According to a survey by the Global Finance Literacy Excellence Center, 63% of Americans are considered financially illiterate. In addition, a report by the Brookings Institution found that teenage financial literacy is positively correlated with asset accumulation and net worth by age 25. But for adults out of high school and college, finding a quality personal finance class can be harder than learning to balan

-

cnbc wrote a new post, The No. 1 thing every business owner needs to do to protect their legacy, on the site US Stock Info 4 years, 9 months ago

Entrepreneurs may find themselves in the market for key man insurance, sometimes more appropriately called key person insurance, because potential lenders and/or investors insist on it. As with any type of coverage, there are a number of issues to consider when mulling key man insurance. The firm has designed a proprietary calculator to help business owners get a sense of their coverage needs. Key employee disability income insurance, on the other hand, helps protect a business from losses assoc

-

cnbc wrote a new post, US existing home sales fall in January, on the site US Stock Info 4 years, 9 months ago

The National Association of Realtors said on Friday existing home sales declined 1.3% to a seasonally adjusted annual rate of 5.46 million units last month. December’s sales pace was revised down to 5.53 million units from the previously reported 5.54 million units. Economists polled by Reuters had forecast existing home sales falling 1.8% to a rate of 5.43 million units in January. Last month, existing home sales were unchanged in the Northeast and rose in the Midwest and the populous South. Ex

-

cnbc wrote a new post, 5 things to know before the stock market opens Friday, on the site US Stock Info 4 years, 9 months ago

Dow tracking for first weekly loss this monthTraders work on the floor of the New York Stock Exchange (NYSE) on January 27, 2020 in New York City. Dow component Coca-Cola said Friday that negative impact from the coronavirus will shave 1 to 2 cents off first-quarter per-share earnings. Over the course of the afternoon, the Dow recovered two-thirds of those losses and closed off 128 points. Health officials in China on Friday reported more than 500 coronavirus cases traced back to four mainland p

-

cnbc wrote a new post, AMD could see a 35% decline after massive run, trader warns, on the site US Stock Info 4 years, 9 months ago

The shares fell more than 2% on Thursday after Wells Fargo analysts downgraded AMD from overweight to equal weight. Todd Gordon, managing director at Ascent Wealth Partners, said the stock had broken out from a yearslong consolidation. But, after breaking out, Gordon worries that it could have run too far, too fast and be setting up for a pullback to $38. He said he’s not only concerned the stock has “run too far, too fast” but is also fearful of competitors in the market. AMD will get the chanc

-

cnbc wrote a new post, Expectations for a rate cut will fade as coronavirus fear eases, Fed’s James Bullard says, on the site US Stock Info 4 years, 9 months ago

Markets expecting an interest rate cut are reacting to the coronavirus scare and likely will reverse once the fear starts to fade, St. Louis Fed President James Bullard said Friday. Central bank officials have indicated that they are content to keep policy on hold as they watch economic developments play out. “There’s a high probability that the coronavirus will blow over as other viruses have, be a temporary shock and everything will come back. The statement helped exacerbate a sell-off that ca

-

cnbc wrote a new post, Stocks making the biggest moves in the premarket: Deere, Coca-Cola, Chewy, First Solar & more, on the site US Stock Info 4 years, 9 months ago

Dropbox (DBX) – Dropbox reported quarterly earnings of 16 cents per share, beating consensus by 2 cents a share. First Solar (FSLR) – First Solar earned an adjusted $2.02 per share for the fourth quarter, short of the $2.72 per share profit that Wall Street analysts had anticipated. Fitbit (FIT) – Fitbit posted an unexpected loss of an adjusted 12 cents per share, compared to predictions of a 3 cents per share profit. Texas Roadhouse (TXRH) – Texas Roadhouse beat estimates by 9 cents a share, wi

-

cnbc wrote a new post, Here are Friday’s biggest analyst calls of the day: Domino’s, Chewy, Shake Shack & more, on the site US Stock Info 4 years, 9 months ago

Stifel downgraded the pizza restaurant chain mainly on valuation after the company’s strong earnings report. “We are adjusting our rating on DPZ to Hold from Buy based on the surge in valuation following a strong 4Q sales and earnings report. Although we remain highly confident in the near and long-term growth outlook for the company, we believe the expectations likely embedded in the current price create a less compelling risk/reward setup. While we believe a valuation premium for DPZ is justif

-

cnbc wrote a new post, Wells Fargo reportedly near $3 billion settlement with SEC and DOJ over sales scandal, on the site US Stock Info 4 years, 9 months ago

Pedestrians walk past a Wells Fargo & Co. bank branch in New York, U.S., on Thursday, Oct. 6, 2016. Wells Fargo is nearing settlements with the Securities and Exchange Commission and the Justice Department over its extensive customer abuse in its banking and lending businesses, according to a New York Times report. The nation’s fourth-largest bank, Wells Fargo has remained muddled in restructuring and regulatory reforms since 2016 stemming from the scandals at its consumer-facing community bank.

-

cnbc wrote a new post, What to watch today: Dow to drop, Dems spending totals and big Buffett weekend, on the site US Stock Info 4 years, 9 months ago

Shares of Dropbox (DBX) were gaining about 11% in the premarket after the online storage company beat estimates with quarterly earnings and revenue. The solar power company also saw revenue come in below estimates. Fitbit (FIT) posted an unexpected loss of an adjusted 12 cents per share, compared to predictions of a 3 cents per share profit. The maker of wearable fitness devices also saw revenue come in below forecasts, as it sold more devices but at lower prices. Texas Roadhouse (TXRH) beat est

-

cnbc wrote a new post, The Federal Reserve thinks low rates have had only a ‘modest’ impact on stock market prices, on the site US Stock Info 4 years, 9 months ago

That’s contrary to the conventional Street wisdom which ties the low rates and money-printing to a market bull run that is less than a month away from its 11th anniversary. “I think that the conventional wisdom is valuations look high, but not at this level of interest rates. But Booth said that adjusting earnings for the historically low interest rate environment actually does put valuations around the dotcom bubble era of the late 1990s. “With interest rates so low, you wonder what the next sh

-

cnbc wrote a new post, Deere rises after tractor-maker reports better-than-expected earnings, says farming stabilizing, on the site US Stock Info 4 years, 9 months ago

A Deere & Co. John Deere 9560 combine harvester unloads soft red winter (SRW) wheat during a harvest in the village of Kirkland in Dekalb, Illinois, July 9, 2018. Shares of Deere spiked Friday morning after the agriculture company topped estimates for its fiscal first quarter and said the farming sector in the United States is starting to stabilize. The company reported $1.63 in adjusted earnings per share and $6.53 billion of revenue for the quarter. Analysts expected $1.25 in earnings per shar

-

cnbc wrote a new post, (no title), on the site US Stock Info 4 years, 9 months ago

(This story is for CNBC Pro subscribers only.) The twenty most popular stocks among hedge funds are beating the market by an average of more than 5 percentage points so far this year, according to a client note from RBC Capital Markets. The firm analyzed the quarterly reports of more than 350 hedge funds, which show holdings as of Dec. 31, to find the most popular stocks by value held by the funds. Of the top 20 stocks, 11 were not in the top 20 of market cap for the S&P 500 as of the end of las

-

cnbc wrote a new post, (no title), on the site US Stock Info 4 years, 9 months ago

Growth stocks just did something they’ve never done before. The IVW growth ETF has surged relative to the IVE value ETF, breaking above 2000 highs to hit a record. Todd Gordon, managing director at Ascent Wealth Partners, said the tide has turned back to growth as the market leader. “What you’re seeing here is growth outpacing value and that discussion everyone had over the last say six to 12 months in terms of value outpacing growth was just this little consolidation,” Gordon said Thursday on C

-

cnbc wrote a new post, (no title), on the site US Stock Info 4 years, 9 months ago

Bottles of French Champagne sit in a cellar in Reims, France, on February 20, 2020. Sales to the United States, the largest export market for French wines and spirits, rose 16% to $3.9 billion in 2019. Sales to the United Kingdom, the second-largest export market for French wine and spirits, rose by 4.4% to approximately $1.5 billion. Still, Champagne exports eclipsed domestic consumption for the second year in a row at 155.5 million bottles or 52.5% of total production. The French market accoun

-

cnbc wrote a new post, (no title), on the site US Stock Info 4 years, 9 months ago

Coca-Cola said Friday that the COVID-19 outbreak could drag down its first-quarter earnings by as much as 2 cents. Despite the hit to its first-quarter financial results, the company still expects to meet its full-year targets. Coke estimates 2020 organic revenue will grow by 5% and adjusted earnings per share will increase by 7% to $2.25. In 2019, the company reported net sales of $37.3 billion and earnings per share of $2.07. The company expects to provide more information about the outbreak’s

-

cnbc wrote a new post, (no title), on the site US Stock Info 4 years, 9 months ago

The U.K. government is phasing out the sale of both wet wood and house coal for “domestic burning” as it seeks to encourage the use of cleaner fuels in households. Under the U.K. government’s plans, sales of wet wood and coal for domestic burning will be phased out between 2021 and 2023. As the name indicates, wet wood contains moisture. “Burning coal for heat and power has to stop and strong guidance is needed to insist that if wood is burnt in approved stoves, it is non-contaminated and dry.”

-

cnbc wrote a new post, (no title), on the site US Stock Info 4 years, 9 months ago

The cancellation of trade events around the world cuts across the hotel, airline, entertainment and other industries. The global business events industry generated $2.5 trillion worth of business sales in 2017, according to the latest research from the Events Industry Council and Oxford Economics. However, with more than 75,700 cases of the virus and at least 2,130 deaths, event organizers say postponing conferences is necessary. Serious financial issuesRescheduling can pose serious financial is

-

cnbc wrote a new post, (no title), on the site US Stock Info 4 years, 9 months ago

Atlanta Federal Reserve President Raphael Bostic became the latest central banker to advocate a hold on interest rates, telling CNBC that he doesn’t see a need to change given current conditions. Despite the market pricing in up to two cuts this year, Bostic said that unless there’s a significant shift in economic performance, the Fed should stay put. “There are many different scenarios about what’s going to happen between now and say June or July. My baseline expectations are that the economy i

- Load More

cnbc