-

cnbc wrote a new post, WHO says it’s too early to declare a coronavirus pandemic: ‘Now is the time to prepare’, on the site US Stock Info 4 years, 9 months ago

As cases of the new coronavirus surge outside of China, world health officials said Monday that other countries should start preparing for epidemic outbreaks of COVID-19 to cross their borders. And health officials in Iran have confirmed 61 total cases in the country, with 12 deaths nationwide. The localized outbreaks outside of China are fueling concerns among infectious disease experts and scientists that the virus has become a pandemic. However, WHO officials declined to declare it as one on

-

cnbc wrote a new post, White House planning to ask Congress for emergency funds to fight coronavirus spread, on the site US Stock Info 4 years, 9 months ago

Secretary of Health and Human Services Alex Azar and members of the Trump Administration’s Coronavirus Task Force hold a press briefing at the White House on January 31, 2020 in Washington, DC. The White House is planning to ask Congress to approve an emergency spending package to help the Trump administration battle the spread of the coronavirus, a source familiar with the situation told CNBC on Monday. The proposed spending deal could be sent to Congress as soon as this week, the source said.

-

cnbc wrote a new post, Blackstone’s Byron Wien says sell-off is not the start of a bear market, on the site US Stock Info 4 years, 9 months ago

Blackstone Vice Chairman Byron Wien told CNBC that Monday’s sell-off amid the spreading coronavirus outbreak was not the start of a bear market. It’s a serious correction related to a fundamental development,” Wien said in a “Squawk Alley” interview. “The fundamental development will be corrected ultimately, and the market will resume its previous direction, which was positive.” Even with the virus outbreak hurting economic growth for at least the first quarter, Wien said the domestic and global

-

cnbc wrote a new post, Goldman cuts US first-quarter GDP forecast to just over 1% on the coronavirus, on the site US Stock Info 4 years, 9 months ago

Goldman Sachs lowered its U.S. growth outlook for the first quarter as the domestic economy takes a hit from the global coronavirus outbreak. The bank slashed its U.S. GDP growth forecast to just 1.2% from 1.4%, seeing a more severe drag from the epidemic. “An increasing amount of companies [are] suggesting potential production cuts should supply chain disruptions persist into Q2 or later.” The number of coronavirus cases outside China surged recently, stoking fears of a prolonged global economi

-

cnbc wrote a new post, Stocks making the biggest moves midday: Apple, Nvidia, L Brands, Tilray, Zoom Video & more, on the site US Stock Info 4 years, 9 months ago

Las Vegas Sands, Wynn Resorts, MGM Resorts — Major casino stocks with exposure to Macao dropped on Monday morning as coronavirus cases accelerated outside of China. Shares of MGM Resorts were down about 4.2%, while Las Vegas Sands fell 3.4% and Wynn Resorts dropped 2.7%. Apple, Nike — Tech giant Apple slid more than 4% as the coronavirus outbreak weighed on the broader market. L Brands — L Brands shares dropped 3% after a Baird analyst downgraded them to neutral from outperform. Beyond Meat — Sh

-

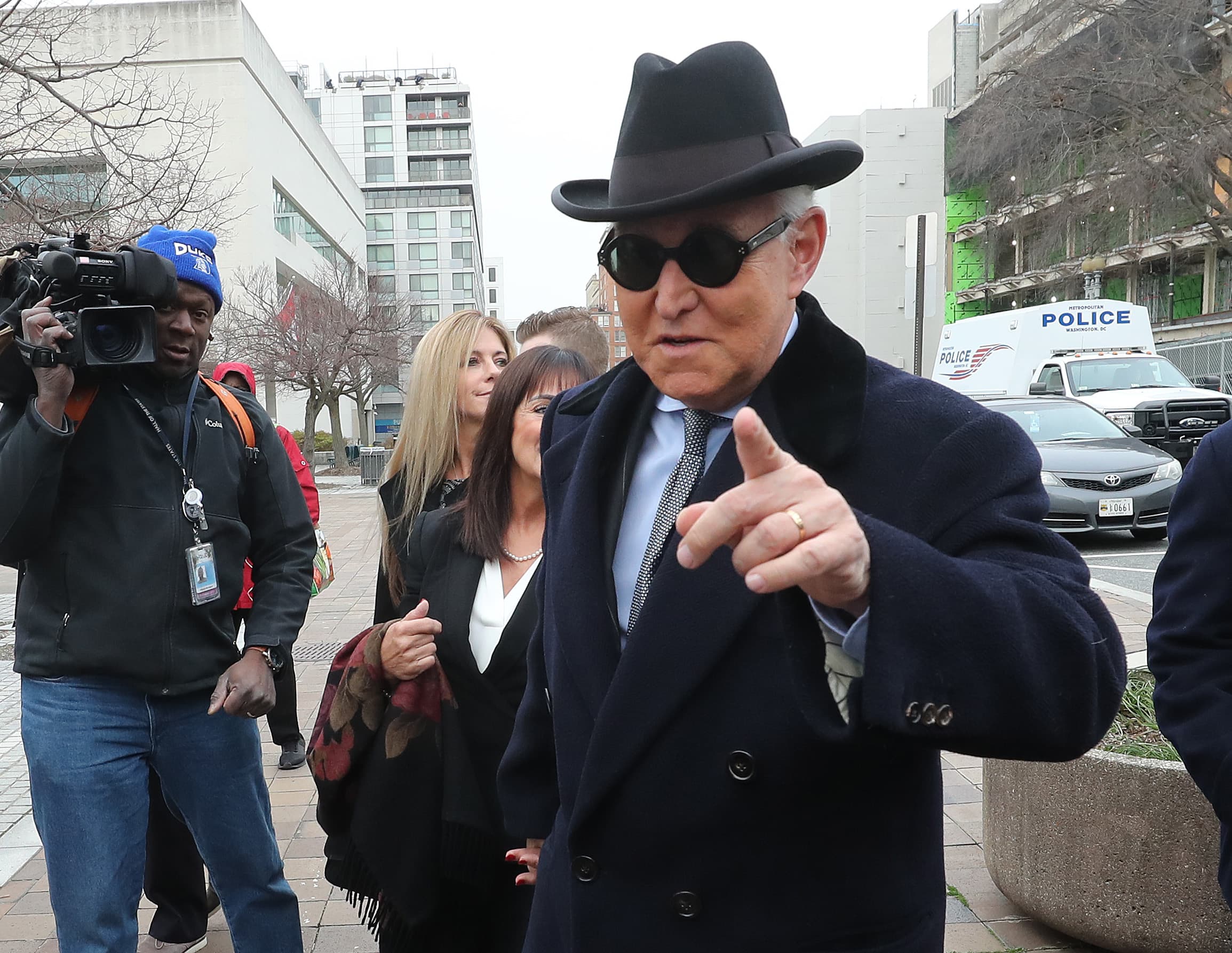

cnbc wrote a new post, Roger Stone judge refuses to withdraw from case, sets hearing for new trial bid by Trump friend, on the site US Stock Info 4 years, 9 months ago

Former advisor to U.S. President Donald Trump, Roger Stone, arrives at the E. Barrett Prettyman United States Courthouse, on February 20, 2020 in Washington, DC. The judge handling Roger Stone’s criminal case flatly refused on Monday his request that she withdraw from the case, and scheduled a hearing for Tuesday on his motion for a new trial. In her order, Judge Amy Berman Jackson said the hearing in U.S. District Court in Washington would be closed to the public, but she also scheduled a heari

-

cnbc wrote a new post, Bloomberg’s $400 million bet looks increasingly likely to flop as he lags in Super Tuesday states, on the site US Stock Info 4 years, 9 months ago

Mike Bloomberg’s $400 million bet on his 2020 presidential campaign – pegged heavily to his performance on Super Tuesday – is looking more and more likely to flop. The five largest states to vote on Super Tuesday will be California, Texas, North Carolina, Virginia and Massachusetts. The bad math for the Bloomberg campaign marks a reversal in momentum from just a few weeks ago. The campaign appeared to be ascendant in national and state polling until Bloomberg’s disastrous performance during the

-

cnbc wrote a new post, History shows stocks typically rebound from disease outbreaks before long, on the site US Stock Info 4 years, 9 months ago

Within six months, stocks are usually on the mend from the fallout of disease outbreaks such as the coronavirus, say experts. Six months later? In 2016, the Zika virus, linked to birth defects in the babies of mothers infected while pregnant, tore through Latin America, the Caribbean and the U.S. The deadly Ebola virus that broke out two years later dragged global stocks down more than 7%. “It’s a topic that feels closer to home and therefore has a more dramatic response in the market,” Egan sai

-

cnbc wrote a new post, The rate rout is heating up, and that could be good news for homebuilders, on the site US Stock Info 4 years, 9 months ago

Monday’s monster sell-off is sending interest rates into a tailspin. “Anything that is obviously rate sensitive, or inversely correlated has an opportunity to continue to do well if, and as, rates continue to plunge,” Worth said Friday on “Options Action.” One of those rate-sensitive plays is the homebuilder space. The Home Construction ETF (ITB) and the S&P Homebuilders ETF (XHB) have pulled back only slightly in Monday’s sell-off compared with other stocks, and are off to healthy starts in 202

-

cnbc wrote a new post, Watch now: ETF Edge on hideout trades for the sell-off and China ETFs, on the site US Stock Info 4 years, 9 months ago

CNBC’s ETF Edge is dedicated to the fastest-growing trend in investing right now: ETFs. Every Monday, Bob Pisani will be joined by a panel of top market participants at the NYSE to offer educational and actionable advice to help you build your best portfolio.

-

cnbc wrote a new post, Mike Bloomberg prepares media onslaught against Democratic front-runner Bernie Sanders, on the site US Stock Info 4 years, 9 months ago

Democratic presidential candidates Sen. Bernie Sanders (I-VT) (R) and former New York City mayor Mike Bloomberg take a break during the Democratic presidential primary debate at Paris Las Vegas on February 19, 2020 in Las Vegas, Nevada. Mike Bloomberg’s presidential campaign plans to unleash its cash-flush media operation against Bernie Sanders in the wake of the Vermont senator’s resounding victory in the Nevada caucuses. A Bloomberg campaign spokesperson did not return a request for comment. B

-

cnbc wrote a new post, Billionaire investor Howard Marks says investors are ‘not discriminating’ between stocks as market sells off, on the site US Stock Info 4 years, 9 months ago

Billionaire investor Howard Marks said he is unsure about the risk of the coronavirus to the markets but that Monday’s sharp fall for stocks was a product of a change in sentiment and not pessimism about individual companies. The pullback was widely spread, with decliners at the New York Stock Exchange outnumbering advancers nine to one, according to FactSet. Marks, the co-chairman of Oaktree Capital Management, said investors tend to be too optimistic or too pessimistic about economic condition

-

cnbc wrote a new post, Goldman has a defensive portfolio for clients to turn to in rough markets – Here’s what’s in it, on the site US Stock Info 4 years, 9 months ago

Trader Michael Urkonis works on the floor of the New York Stock Exchange, January 28, 2020. Coronavirus fears triggered a steep sell-off in stocks as investors worry that the epidemic would disrupt the global economic growth. Goldman Sachs has a defensive portfolio it provides clients for times just like these. But the stock basket also has a long track record of beating the market in good times and bad. Here’s what’s in it.

-

cnbc wrote a new post, Bill Gates was an angry, difficult boss in early Microsoft days—here’s why employees still liked him, on the site US Stock Info 4 years, 9 months ago

Take Microsoft co-founder Bill Gates: In addition to his groundbreaking innovations, the billionaire is best-known today as a kind, compassionate and soft-spoken philanthropist. Former Microsoft employees described the office as a very confrontational environment, with Gates being “demanding” and the work “intense.” In a 2006 blog post, Spolsky writes about his first in-person product spec review with Gates. “The lower the f***-count, the better,” Spolsky recalls. As the meeting progressed, the

-

cnbc wrote a new post, If you invested $1,000 in American Express 10 years ago, here’s how much you’d have now, on the site US Stock Info 4 years, 9 months ago

How American Express got its startAmerican Express dates to 1850, when it started as a freight shipping company. In 1966, it put forth a corporate card program for businesses, and in 1991, created its first loyalty program, now called Membership Rewards. Since then, American Express has continued to reiterate its financial offerings by introducing lines of debit and credit cards as well as banking services. American Express’ stock performanceThrough the years, American Express stock gone up and

-

cnbc wrote a new post, Warren Buffett: You should be able to do one simple thing before buying any stock, on the site US Stock Info 4 years, 9 months ago

But Berkshire Hathaway CEO Warren Buffett says there’s one you should always avoid: Buying a stock merely because you think it’s going to increase in price. That’s because even the best investors aren’t able to predict how the market will perform. Instead, you should invest in companies that you both understand and believe will offer long-term value, according to Buffett. No matter how much or how little you’re buying, you should be able to get your reasoning down on paper without relying on out

-

cnbc wrote a new post, Dow briefly tumbles 1000 points—Investor expert on what to do, on the site US Stock Info 4 years, 9 months ago

Dow briefly tumbles 1000 points—Investor expert on what to doJosh Brown, Ritholtz Wealth Management, Bryn Talkington, Requisite Capital Management managing partner, and Howard Marks, Oaktree Capital co-chairman, join ‘Fast Money Halftime Report’ to discuss the state of the markets amid the fears of the coronavirus outbreak.

-

cnbc wrote a new post, Howard Marks on investor psychology during coronavirus fears, on the site US Stock Info 4 years, 9 months ago

Howard Marks on investor psychology during coronavirus fearsJosh Brown, Ritholtz Wealth Management, Bryn Talkington, Requisite Capital Management managing partner, and Howard Marks, Oaktree Capital co-chairman, join ‘Fast Money Halftime Report’ to discuss the state of the markets amid the coronavirus outbreak.

-

cnbc wrote a new post, Oil slides into bear market territory, posting worst day in more than a month on coronavirus fears, on the site US Stock Info 4 years, 9 months ago

Oil slid more than 5% at its session low on Monday, falling into bear market territory as the number of coronavirus cases outside of China surged. Raymond James cut its oil outlook on Monday as the number of coronavirus cases continues to rise. Molchanov said demand in the first quarter will be reduced by an average of 1.5 million barrels per day. A week ago, the firm’s forecast stood at a potential build of over one million barrels per day for the quarter. The firm also raised its first quarter

-

cnbc wrote a new post, Harvey Weinstein trial: Guilty of rape and criminal sexual act, but acquitted of top sex charges, on the site US Stock Info 4 years, 9 months ago

Film mogul Harvey Weinsten was found guilty Monday of rape and committing a criminal sexual act more than two years after news articles about his alleged serial sexual abuse of women ignited the MeToo movement. Weinstein was surrounded by court officers during the reading of the verdict, keeping a stoic look on his face as each verdict was announced. Weinstein, as the verdict was read, “just kept repeating, ‘But I’m innocent, but I’m innocent, I’m innocent, how could this happen in America?’ Wei

- Load More

cnbc